Navigating the Path to Homeownership: Your Step-by-Step Guide

The home buying process varies by state, region, and even county. Because it’s one of the most significant financial decisions you’ll ever make, knowing what to expect is the best way to ensure a smooth, stress-free experience.

At Mid Penn Realty, we want you to feel confident from the first search to the final walkthrough. To help, we’ve created a Printable Home Buying Process PDF and a House Hunting Feature Checklist to keep your journey organized.

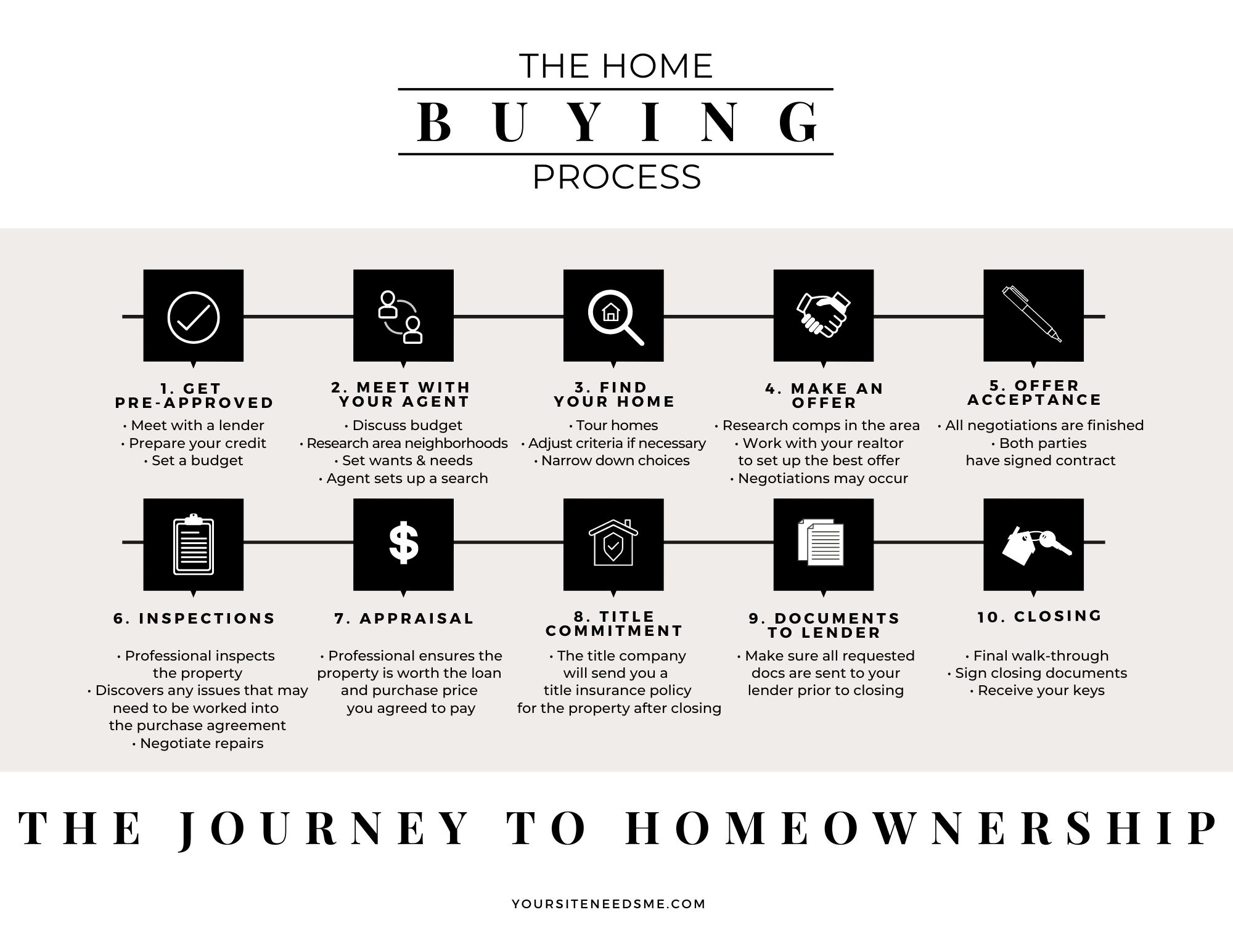

Your Home Buying Milestones

1. Get Pre-Approved Before you fall in love with a house, determine your budget. Use the Mortgage Calculator on our website to get a baseline, then meet with a lender for a formal pre-approval. Not sure who to call? Ask your bank, seek referrals from friends, or ask your Mid Penn Realtor for a trusted local suggestion.

2. Choose a Professional Real Estate Agent You deserve an expert who represents your best interests. Look for a Realtor® with deep knowledge of the local market and the specific neighborhoods you love. Once you partner with an agent, they will tailor a property search specifically to your needs.

3. Start Your Search For the most accurate data, skip the national apps and search directly on a local agent’s website. Our site is synced with the MLS, providing real-time updates.

-

Pro Tip: Sign up for Property Alerts by saving your search. You’ll be the first to know when a new home hits the market or a price drops!

-

The Tour: Schedule tours with your agent to see favorites in person and narrow down your options based on your “must-haves.”

4. Make an Offer & Negotiate Found “the one”? Your agent will help you craft a competitive offer and handle negotiations with the seller until an agreement is reached.

5. Offer Acceptance Once negotiations wrap up, both parties sign the purchase agreement—you are officially under contract!

6. The Home Inspection Protect your investment by hiring a professional inspector. They will check the home’s “bones” and systems. Depending on the results, your agent may help you request repairs or credits before moving forward.

7. Home Appraisal Your lender will order an appraisal to ensure the home’s value aligns with the purchase price. This is a vital step in securing your financing.

8. Title Research & Insurance The title company dives into the property’s history to ensure there are no hidden liens or claims. They will also offer title insurance, which protects you and your lender from future ownership disputes.

9. Final Documentation Stay in close contact with your lender during this stage. You’ll provide final bank statements or updated paperwork to ensure your loan is ready for clear-to-close.

10. Closing Day The finish line! You’ll perform a final walkthrough, sign your paperwork (usually at the title company), and finally get the keys to your new home.

11. Moving Day It’s time to make your dream a reality! Pack the truck, enlist your friends, and start making memories in your new space.

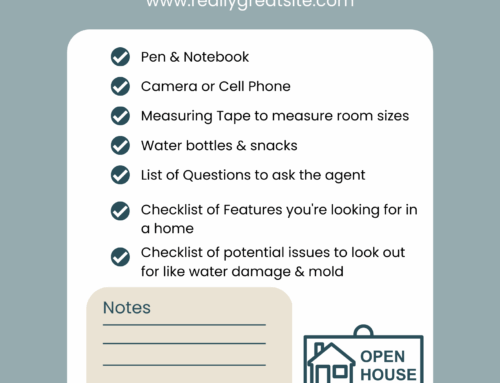

Download Your Bonus Checklist

Ready to hit the pavement? Don’t go house hunting without our Printable House Hunting Checklist. It’s the perfect companion for keeping track of the pros and cons of every home you visit.